General Information

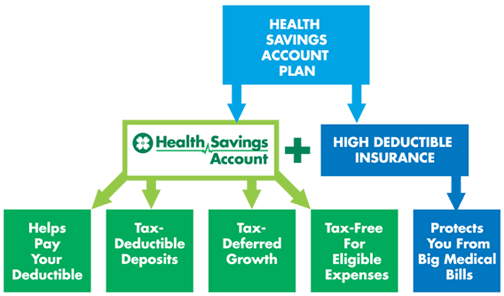

Simply stated, an HSA is what you get when you combine a high-deductible health insurance plan and a tax-exempt savings account. They are designed to allow individuals to use pre-tax dollars to help pay for current and future medical expenses.

To get the benefits of an HSA, the law requires that the savings account be combined with a high deductible health insurance plan. High deductible health insurance plans reduce your monthly health care premiums.

- Contributions are 100% tax deductible

- You choose when to make your contributions and how to invest them

- Contributions to your HSA by your employer are excluded from your gross income

- Unused funds rollover from year to year

- The interest or other earnings on the assets in the account are tax deferred

- Funds can be used at any time for qualified medical expenses tax-free

- Employers and employees can contribute to an HSA as long as the account holder meets the requirements for HSA eligibility

- Family members or any other person can make contributions on behalf of an eligible individual

It stays in your account. The funds in your HSA are your money, there is no "use it or lose it" rule. Funds accumulate and carry over from year to year.

- Contributions are 100% tax-deductible for the account holder (excluding employer contributions)

- Funds grow on a tax-deferred basis and if the funds are used for an eligible expense, the funds are tax-free

- Funds rollover from year to year

- After age 65, funds can be used tax-free for eligible expenses, including Medicare premiums, or taxed with no penalty for other expenses

Yes. Your HSA funds can be used for your spouse and dependent children's out-of-pocket eligible expenses, even if they are not on your health plan.

Enrollment and Contributions

County of Boone will contribute $1,200 annually for an individual and family health plan (employee + additional individual).

You will receive contributions to your HSA with each paycheck. Currently $50.00 per paycheck, based on 24 paychecks.

The IRS has a maximum limit for your HSA contributions.

| Contributions | Employee | Family Coverage* |

|---|---|---|

| IRS Contribution Limit | $4,300 | $8,550 |

| IRS Contribution Limit age 55 and older |

$5,300 | $9,550 |

| Contributions | Employee | Family Coverage* |

|---|---|---|

| IRS Contribution Limit | $4,400 | $8,750 |

| IRS Contribution Limit age 55 and older |

$5,400 | $9,750 |

* Family coverage consists of Employee plus one other person

You have several options:

- Make contributions through payroll

- Download Central Bank's mobile app and use Mobile Check Deposit

- Visit a Central Bancompany branch

- Make a funds transfer using Online Banking

Taking money out of your HSA is as easy as taking money out of your checking account. There are no claims to file and you can simply use your HSA debit card or use Online Bill Pay. If you choose to reimburse yourself for eligible expenses, you can simply make a funds transfer using Online Banking, use Online Bill Pay or withdrawal funds at an ATM.

Distributions from your HSA

Yes. The IRS requires your HSA to be an individual account, but you may name other people as authorized signers and they will receive debit cards.

In January, you will receive a 1099-SA and a 5498-SA from Central Bank to use in filing your taxes along with your W-2.

As of age 65, funds can continue to be used for eligible medical expenses tax-free. You may also use the funds for non-eligible expenses and you are only subject to ordinary income tax without any IRS penalty. If you are covered by Medicare, usually at age 65, you can no longer make contributions to an HSA. Funds may still be used for eligible expenses, including Medicare premiums, tax-free.

If you are under the age of 65, you will owe income tax plus a 20% IRS penalty. After 65, the 20% penalty is waived and you will only owe income tax, much like an additional retirement plan.

No. Unlike an FSA, the funds must be in your HSA before you can use them. However, you are able to reimburse yourself for the eligible expense when funds are available.

Funds in your HSA earn interest automatically. You also may choose to invest excess funds by selecting "Invest My Excess HSA Funds" on your HSA activity page in Online Banking or by visiting with one of our investment representatives.